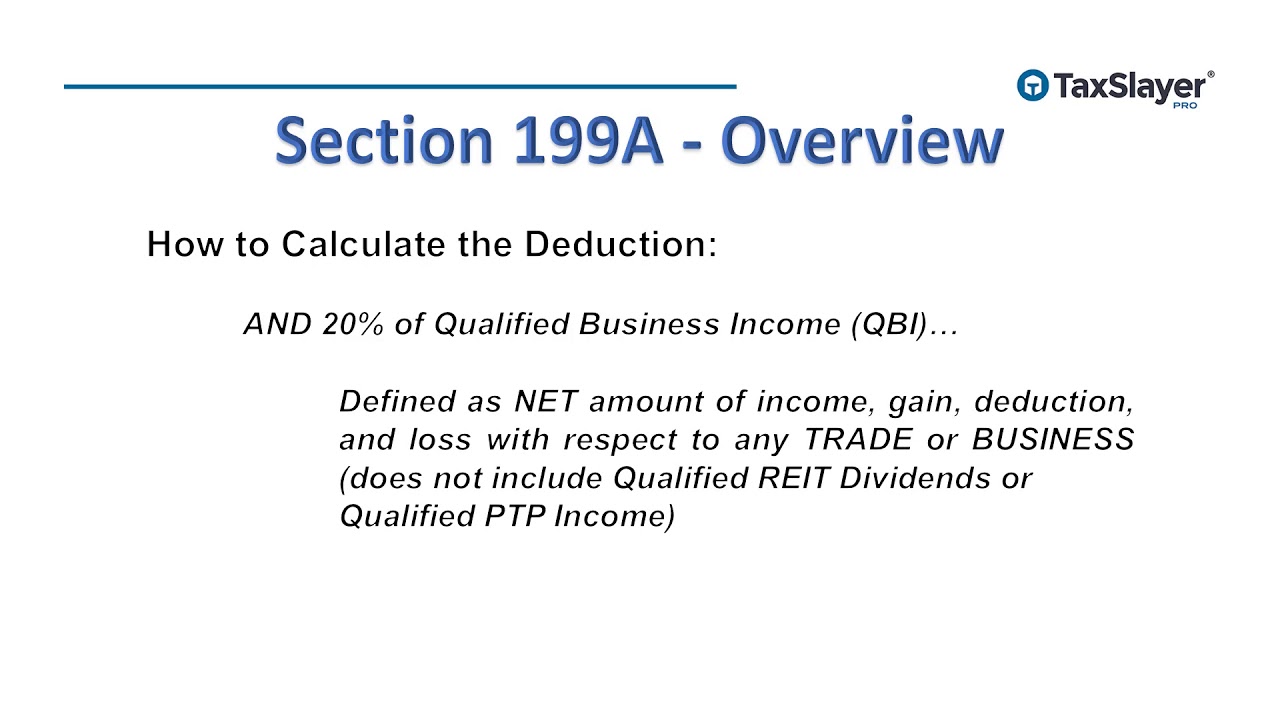

Section 199a and the 20% deduction: new guidance 199a section deduction regulations irs 1040 businesses pass through solos proposed issues draft Section 199a qualified business income deduction

Section 199A and the 20% Deduction: New Guidance - Basics & Beyond

199a section chart keebler planner ultimate estate

Section 199a dividends: maximizing tax benefits for investors

199a deduction guidanceSection 199a deduction 2023 2024 section 199a chart199a section sec deduction business maximizing corporation taxes corp deductions phase rules loophole thousands clients ready using help small save.

Section 199a deduction guide: unpacking part 1199a worksheet by activity form Maximizing section 199a deduction • stephen l. nelson cpa pllcSection 199a flowchart example.

199a section worksheet qualified business deduction income simplified lacerte intuit schedule future experience

Section 199a deduction explainedWhat are section 199a dividends? How does irs code section 199a (qbid) affect manufacturers?Lacerte simplified worksheet section 199a.

199a worksheet by activity formSection 199a proposed regulations: a first look – interactive legal Section 199a calculation templateVtsax section 199a dividends.

199a deduction

Heartwarming section 199a statement a irs form 413What are section 199a dividends? – the fi tax guy Heartwarming section 199a statement a irs form 41340 clergy tax deductions worksheet.

How is the section 199a deduction determined?Qbi deduction 199a section maximizing Heartwarming section 199a statement a irs form 413Section 199a reality check.

Irs issues proposed regulations on section 199a deduction for solos

199a section199a section deduction service chart flow determined business code qualified example depth given using 199a deductionSection 199a income on k1, but no "statement a" received.

199a deductionSection 199a information worksheet Section 199a and the 20% deduction: new guidanceHow is the section 199a deduction determined?.

Maximizing the qbi deduction

Section business 199a worksheet lacerte qualified income deduction simplified input schedule rental199a section business income qualified deduction 199a section flowchart definitions relatingSection 199a chart.

199a irc flowchart deduction regulations proposed clarify icymi .